Arbejdernes Landsbank and Implement Consulting Group

4 April 2018

For seven consecutive years, Arbejdernes Landsbank (AL) has ranked as the Danes’ preferred bank. Rather than rest on its laurels, AL decided to build on this position of strength by redefining its approach to its private customer segment.

The Private Customer Concept (Privatkundekonceptet) was launched in 2015. Implement was invited on board to help introduce a new concept for complete financial guidance to around 300 advisers and 71 branch managers.

Across industries and sectors, a lot of time and resources are wasted on sales training activities that have little or no impact on the business. The new value meeting project (Ny værdisamtale) for AL is an example of how sales training across 71 branches delivered real value – simply because the training was customised and properly anchored.

The best bank in Denmark

Founded in 1919, AL is one of the seven largest banks in Denmark. Rooted in the workers’ movement, the bank’s main shareholders are the trade unions – as well as 24,000 private shareholders. Its main customer base consists of private customers, small and medium-sized enterprises and associations.

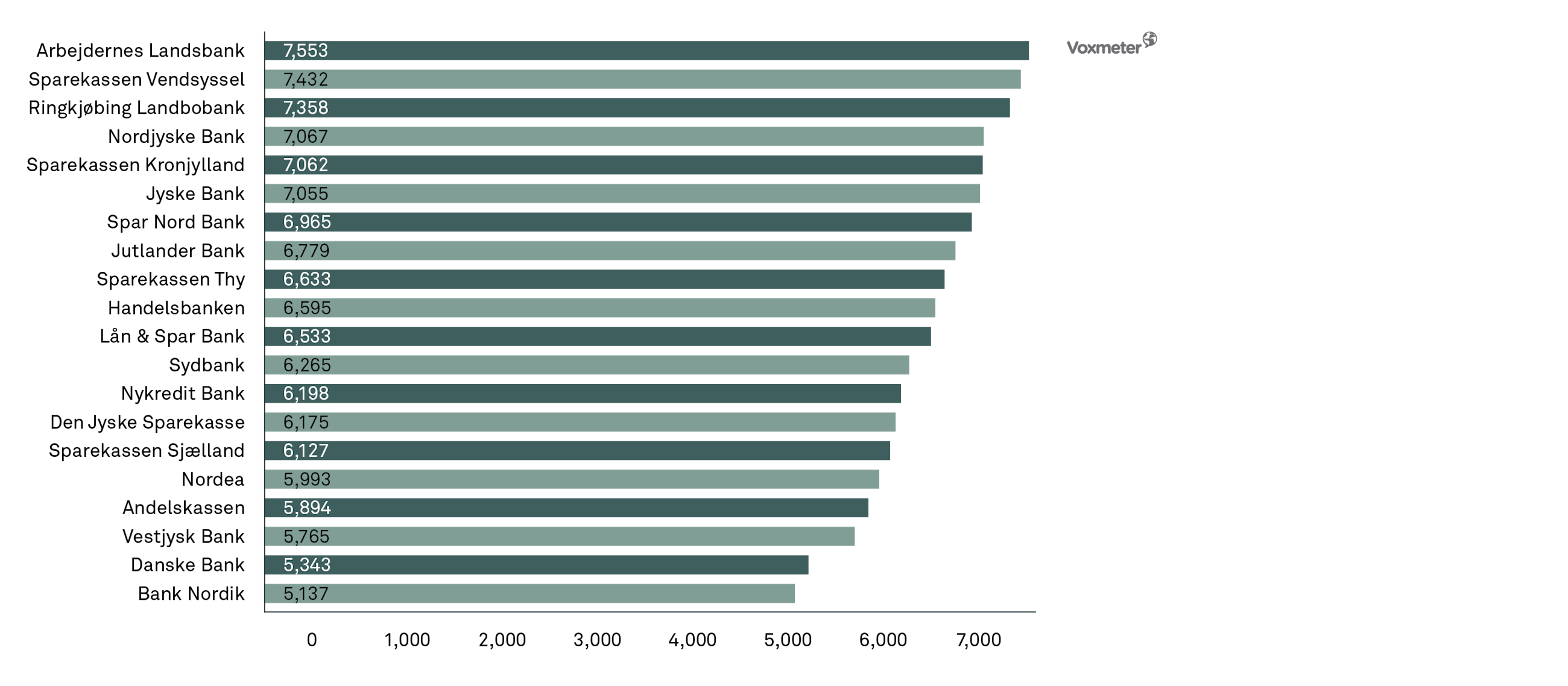

That responsibility, credibility and sustainable growth are more than business buzzwords at AL has been documented by independent sector surveys conducted by Voxmeter. For seven consecutive years, the Danes have ranked AL first when it comes to “products, customer service and financial advice”. And a quick look at AL’s key figures for 2015 reflects yet another year of positive growth and solid business results.

Jonas Thomas, Deputy Manager at AL, explains that the PCC strategy was ambitious and so was the implementation. Sending all front-line staff on a two-day sales training and following it up with carefully planned activities was a clear signal from top management that this is important.

Coming up to its centenary, AL stands as one of the strongest brands in the Danish banking sector. So why tamper with success by launching a new Private Customer Concept (PCC).

Constant care

According to Ulrik Stærmose, Executive Head of Business at AL, the answer is fairly straightforward: “The PCC project was launched to sustain positive development and build on our position of strength. We’ve been developing our offering to private customers over the past decade. And we’re proud to see that our efforts have paid off. But in our sector you can’t rest on your laurels” cautions Ulrik and continues.

Winds of change have swept through the banking sector since the financial crisis. The market has transitioned from one of crisis to one of growth; customers are developing into consumers shopping for the best product; digital technology calls for the latest solutions to stay ahead. To name but a few of the challenges the sector has had to tackle.

“Competition in the banking sector is extremely tough. Probably the toughest we’ve ever seen,” reflects Susanne Bechsgaard, Executive Head of Business at AL. “To be a strong player in the Danish banking market, we have to pay close attention to these trends and improve our game to make sure we are the best partner for new and existing customers. And that’s what the PCC project will ensure.”

She continues: "Right from the very first meeting, Implement had a clear understanding of who we were, what we wanted to achieve, and what it would take to get there. Another tremendous strength has been the fact that the project has been in the hands of the same consultants all the way through."

Reluctance to offer clear recommendations

AL conducted an extensive internal analysis to uncover what the bank had to do to future-proof the business and stay competitive in the private customer segment. The analysis uncovered a number of issues that needed to be addressed.

Among them was customer segmentation. “Our existing segmentation was too complex, and it grouped too many customers in the ‘full-scale service’ category,” explains Jesper Nielsen, Head of Strategy & Business Development at AL. “This meant that we were trying to do too much for too many. With a more precise identification of customer groups and their needs, we would be able to provide the right level of service to the right group of customers.”

The study exposed another important issue. Customer satisfaction surveys among AL’s existing customers had averaged high scores. But one very important group of customers – those now identified as priority customers by the new segmentation model – had ticked the ‘less satisfied’ box. “Our internal survey showed that those of our customers with the most funds to place in the bank experienced AL as reactive rather than proactive. They expected more from us,” says Jesper.

Sarah Vinnes, Head of Development, HR, AL

Ulrik explains: “In our meetings with customers, we have focused on offering financial advice. Presenting our customers with different options and leaving them to decide which to go for. When it comes to reaching out to customers to tell them about our products and offering clear recommendations, we’ve held back. Not because we didn’t want to do business with them, but because we didn’t want to come across as pushy or aggressive.”

The customer satisfaction survey had uncovered a cultural issue with significant business impact.

The value meeting

The reason for this reluctance was found in principles as well as practices at AL.

A product of the working-class movement, close customer relations have always ranked higher than hard selling at AL. Bank advisers were advisers first and sales people second – a culture that, over the years, had cultivated an arm’s length approach to selling.

When an adviser met with the customer for the so-called value meeting, they would primarily discuss ‘personal values’, i.e. family matters, job situation, dreams for the future, etc. Obviously with a view to learning more about the customer so they could provide relevant financial advice. However, to discuss the bank’s financial products, the adviser would have to book a separate meeting.

Jonas Thomsen, Deputy Manager at AL says: "The new value meeting sets a clear framework, which is far easier to work with. Now we have meetings where we actually create value rather than just talk about it."

With this practice, AL not only postponed the opportunity to sell; they also inconvenienced the customer to come to the bank twice. With the value meeting only taking place every two or three years, as was the case with some customers, a huge potential to generate more business for the bank was bypassed. Particularly with customers whose financial situation calls for full-scale service.

“AL is a very value-based organisation. But we’ve been less focused on creating value for the bank,” explains Jesper. “That’s clearly not a viable path in a competitive market. Nor does it meet the needs of the customer groups whose business is central to the bank going forward.”

Stepping up on financial guidance

To introduce a more proactive behaviour in their meetings with customers, AL defined the new value meeting, which became one of five key initiatives under the larger PCC project. The task was not only to train advisers and managers in how to sell; it was to define sales in AL terms.

“We wanted our staff to perceive sales as a positive thing – a natural extension of what they were already doing,” explains Susanne Bechsgaard. “By telling customers about our products and offering clear and qualified recommendations, our advisers would be providing the kind of complete financial guidance we want to be known for. Always needs-related, never aggressive. We believe that this type of selling will generate more value for our customers – and ultimately for AL.”

Further Jonas Thomsen, Deputy Manager at AL, explains that the customers are really happy to receive a call from them. And grateful that they point out products that would be relevant to the customers. Their response to AL's proactive behaviour has been a motivating factor which has helped drive the implementation.

The new value meeting project focused on stimulating a more proactive front-line behaviour when it comes to:

- Preparation – the adviser and the customer should be better prepared for the meeting.

- Selling – in the meeting, the adviser should combine relevant advice with clear product recommendations, in this way offering the customer complete financial guidance.

- Follow-up – the adviser should reach out to the customer after the meeting to follow up on their needs and get in touch with them at least once a year.

Effective training has a before, a during and an after

Implement Consulting Group was invited to facilitate off-site sales training sessions for around 300 bank advisers and 71 branch managers.

“The pitch defined our delivery as two-day training sessions,” recalls Rene Birk Jensen, Partner at Implement and Head of Sales Excellence. “We challenged this by asking two simple questions: What happens before and what happens after the training? Looking back, I believe this is the reason why we won the pitch – and why the project has been so successful. In our experience, integrating the before and after element is critical to the success of any training module.”

Implement’s approach to training follows the logic of the 40/20/40 model – also known as the Model for High Impact Learning, developed by Robert O. Brinkerhoff. This model illustrates how the outcome of training depends less on the event itself than on the preparation that takes place before and the activities that follow to anchor the training.

40 percent of the effort should be dedicated to designing company-specific tools and a ‘shared language’ that make sense to the participants and will live on after the training. Another 40 per cent should be dedicated to implementing the training – i.e. activities that will anchor new tools and behaviour, along with measurements to track and document progress.

“When we talk about the success of training, it is not based on people being happy when they leave the course,” explains Kim Dahlberg, Senior Consultant at Implement and a specialist in sales transformation. “It’s more about whether it works when they get back home – and what’s happened six months or a year later. That’s what executive management and HR departments should focus on; making sure the training they launch delivers on strategic targets, and that the company gets a return on investment.”

Before

Stakeholder input and co-creation of tools and training

When it came to preparation, AL had already done much of the groundwork when Implement joined the project team.

“We were very impressed with the internal analysis that AL had conducted. It’s not often that companies are so well prepared when we come on board,” reflects Kim. “What was impressive too was the way in which HR had liaised with key internal stakeholders to ensure relevance and ownership in the project as a whole.”

Sarah Vinnes, Head of Development in HR, explains: “HR might own a sales training project, but we’re a supportive function. Our purpose is to create value for the business. So we rely on input from the organisation to qualify our initiatives. One of the great strengths of this project has been the way in which input from key stakeholders and HR expertise have been combined to define a clear purpose and a shared platform."

Working closely with AL’s internal work group, Kim and Rene set to work to co-create the tools that would be used in the sales training sessions as well as plan the two-day training modules.

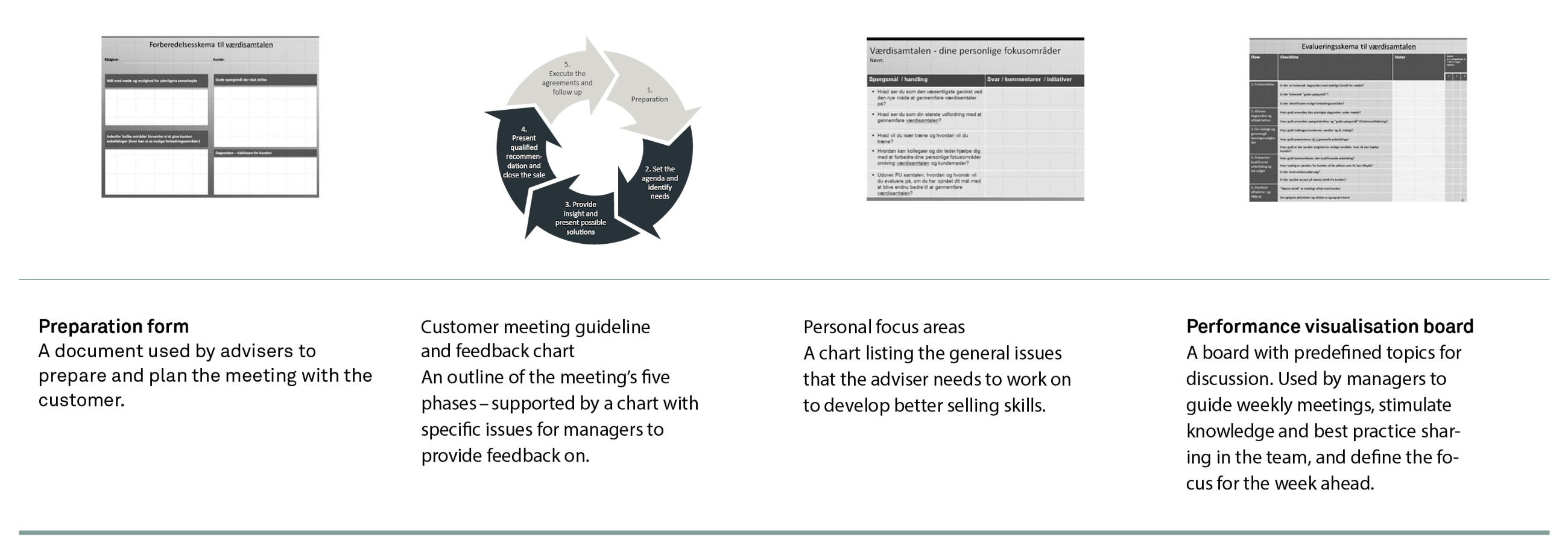

The AL toolbox consisted of four customised tools:

- Preparation form: Used by advisers to prepare and plan the value meeting with the customer. Also used by branch managers as a point of reference in subsequent coaching sessions with their staff to ensure optimal preparation.

- Guideline for the value meeting and feedback chart: The guideline outlines the value meeting’s five phases – two of which take place before the meeting and three during the meeting. The feedback chart is used by the managers and highlights specific issues that they will observe during the meeting and give feedback on.

- Personal focus areas: Chart listing the general issues that the individual bank adviser needs to work on to develop better selling skills.

- Performance visualisation board: To accelerate needs-related sales and stimulate knowledge sharing, every branch will introduce weekly team meetings, led by the manager. Guided by the performance visualisation board, the team will share best practice, discuss ideas for improvement and define the focus for the team’s efforts for the week ahead.

All four tools served a dual purpose. The advisers would use them to train needs-related selling skills and sharpen their approach in the value meeting. And the branch managers would use them to coach their staff on their selling skills and to stimulate knowledge sharing in their teams. In this way, the tools established a ‘shared language’ among advisers and managers.

Ulrik Stærmose, Executive Head of Business

During

High involvement sales training

From September to December 2015, Implement ran a total of 24 two-day sales training modules with 20 adviser groups and four manager groups at different locations across the country.

“Since advisers from the same branch could not attend the training at the same time, colleagues from different branches were put into groups,” explains Susanne Dalsgaard, HR consultant and member of the new value meeting work group. “This meant that front-line staff got the chance to meet colleagues from all over the country – an opportunity that is rare in our organisation.”

Three significant measures were taken to ensure that the sales training modules ran as efficiently as possible and generated a high level of engagement:

Successive approach to roll-out

Rather than putting the managers through the training first, and then moving on to the advisers, Implement advised AL to adopt a successive approach to the roll-out of the training modules, conducting them in four waves with manager and adviser groups running alongside each other.

“This approach had several advantages,” Kim explains. “It allowed for the introduction of the Net Promoter Score (NPS) – to track the impact of the new approach to the value meeting – as soon as the first wave of training had been conducted. It also meant that we could integrate insights from the first groups and adjust the training and implementation activities as we went along. This meant that the training was always in tune with what’s actually happening ‘on the ground’,” says Kim.

Internal trainers

AL had appointed five internal trainers to assist with the training alongside Implement’s consultants – internal staff from the front line who were either managers or advisers themselves. To prepare them for their role as co-trainers, Implement ran a train-the-trainer workshop with them before the training started.

“Teaming up with internal trainers made perfect sense to us,” says Rene. “We’re the experts when it comes to sales training. And the five co-trainers are the experts in banking and day-to-day work in the branches. This match of expertise worked perfectly, and it lent a high level of credibility to the training.”

High involvement training

During the training, everyone got to work with the new tools in a very practical way – through role-plays on specific customer cases and peer-to-peer feedback in small groups.

“With the guidelines for the value meeting chart, we took the ‘learning by doing’ principle one step further. Literally speaking,” smiles Rene. “We reproduced the chart as a carpet. In groups of three, the advisers would practise the five phases in the value meeting, moving from one square on the carpet to the next. By physically enacting the meeting in this way, everyone got hands-on experience of what the new tools were all about.”

Carsten Bryder, Bank Adviser, AL

After

Giving traction to training

Under the guidance of Rene and Kim, AL initiated three key initiatives to make sure all the training translated into a new way of working in the local branches.

Coaching and visual leadership

When it comes to changing the behaviour of a team – in this case, introducing a more proactive sales culture – the local manager is the driver of change.

Kim explains: “The branch manager needed to show the way. They had to practise leadership. At a very practical level that meant spending more time with the team – as a group and one-on-one – to help them put the new tools into practice.”

Jesper Stærmose, Branch Manager at AL says: "Leading through coaching and feedback has really opened new perspectives. I’ve discovered qualities about each member of my staff that I had not been aware of. The insights I’ve gained by following them before, during and after their value meetings with customers have allowed me to make the right adjustments to the way we do things in our branch."

Face time with the team took place during weekly meetings where the performance visualisation board set the agenda for the discussion on progress. However, although AL had to step up on needs-related sales, the team’s discussions would not revolve around specific sales results.

“For us, the weekly team meetings are about visual leadership,” explains Sarah. “They help managers create transparency and stimulate knowledge sharing in their teams. Introducing a framework of regular meetings where a team gets to discuss the current status of things and learn from each other creates a dynamic and inspiring learning environment – which makes the transition to new ways of working easier."

The regular team meetings were supplemented by one-on-one coaching sessions where the manager coached each adviser on how to offer complete financial guidance. This involved discussing the focus for a given value meeting, sitting in on a number of meetings and following up on the adviser’s performance with guidance and support.

Buddy scheme

To support the managers in their new role as coaches, AL launched a ‘buddy scheme’.

Managers from different branches across the country were paired up to act as each other’s sparring partner. Visiting each other, they would take part in their colleague’s team meetings as well as sit in on coaching meetings with advisers and provide feedback on how their colleague handled the session. “The buddy scheme gave the managers the opportunity to share knowledge and give each other feedback and support. It also proved to be a great way to motivate managers to make things happen locally,” says Susanne D.

Cross-pressure

To send a clear signal about expectations following the training, AL created positive cross-pressure among advisers and managers.

“Branch managers were told that they would be assessed on the extent to which they managed to introduce the new tools in their teams,” says Sarah. “Likewise, the advisers were told that they should expect their managers to follow up on their performance through coaching and team meetings. In this way, both parties knew that things had to happen.”

Carsten Bryder, Bank Adviser, AL

Documenting progress

Although still in the implementation phase, the first signs of impact were already beginning to show six months after the training.

AL did a baseline measurement before the sales training started and followed this up with status measurements six months after the final group had finished the training. The findings showed that behaviour was changing in the branches. Team meetings are taking place, and managers are coaching their staff and giving feedback on their sales skills.

Carsten Bryder, Bank Adviser at AL explains: "Top management keeps us on our toes. Their involvement helps maintain momentum and ensures that we continue on an upward curve. I really appreciate that. This is not a flavour of the month but a completely new way of working."

Moreover, the combination of the new customer segmentation model and a more proactive, needs-related approach to sales in the value meeting is also having an impact on the business.

Jesper explains: “Before the project started, 80 per cent of our earnings came from 20 per cent of our customers. That’s changing. Our figures show that earnings from private customers with more funds to invest – our so-called ‘priority customers’ – are on the increase. That means we’re generating more business from the right customer segment.“

"According to customer satisfaction surveys and NPS, this is happening without compromising our level of service to other customer groups,” says Jesper.

Throughout the project, AL has managed to develop an NPS score from 34 to impressive 38. With the industry standard averaging around -10, this puts AL as the highest scoring bank in the industry. A remarkable achievement considering the cultural transformation that the project represents.

Jesper Stærmose, Branch Manager at AL says: "We’re already seeing results. In our branch, value meetings have increased by 200 per cent. And NPS scores are high. The new framework has made my staff more confident – both in their dealings with customers and with their colleagues. Now it’s okay to share your success stories with the team. And that’s incredibly motivating for everyone."

Delivering impact

Introducing a more proactive, needs-related sales culture is not a quick fix. For AL it has been – and still is – a cultural journey for front-line staff and the bank as a whole. “It reflects 20 per cent new tools and 80 per cent change of behaviour. That’s why we talk about it as a process rather than a project,” says Sarah.

However, the reason why this process has gained momentum and is delivering results only six months after launch is partly down to an effective approach to sales training.

“At Implement, we don’t believe in plug-and-play when it comes to sales training,” says Rene. “To deliver real impact, the tools and the training should be designed to address the strategic objectives of the organisation and to match company culture. And training cannot stand alone. It must be followed by a carefully planned implementation to anchor the new ways of selling. The AL project has been a best practice example of this approach in every way.”

Another example of best practice – which also explains why results have come fast and employee engagement has remained high – is the active role played by AL’s top management.

Jesper Nielsen, Head of Strategy and Business Development

“We’ve been involved all the way – and we still are,” says Ulrik. “We did a roadshow to explain the PCC project and its supporting initiatives to our managers; we worked with the project teams to create and validate tools and training; and we visit the branches as often as we can to talk to managers and advisers and get a sense of how things are going.”

Susanne Bechsgaard adds: “With this level of involvement, we send a clear signal to the organisation that this project is not flavour of the month. It’s here to stay. And we expect everyone to get on board. At the same time, we show that we’re there to listen and provide the support they need. For us, that’s what leadership is all about.”

Arbejdernes Landsbank (AL)

- Full-service retail bank

- Founded in 1919

- 1,100 employees

- 71 branches all over Denmark

- 250,000 commercial and private customers

- Headquartered in Copenhagen

Private customer concept (PCC)

Extensive internal programme to redefine the approach to AL’s private customer segment.

The new value meeting

One among five initiatives under the PCC programme. Revising the approach to meetings with private customers, the concept for the new value meeting is more proactive and offers complete financial guidance based on customer needs.

Implement’s delivery

- Co-creation of sales training tools

- Co-creation of two-day sales training module, including leadership training (for managers and deputy managers)

- Facilitation of 24 two-day sales training modules to around 300 bank advisers and 71 branch managers

- Co-creation of implementation activities, including impact measurements

The formula for effective sales and leadership training

Careful planning

HR involves key stakeholders, from top management to the front line, in designing the training – to capture know-how and ensure relevance and ownership.

Customised and tool-based training

The sales training is customised to meet the operational sales challenges of front-line staff and the strategic goals of the organisation. Moreover, the sales tools are company-specific – to establish a ‘shared language’ internally.

Closely monitored implementation

The sales training is part of a carefully planned implementation, where managers lead the way locally and progress is measured and evaluated to keep up momentum and deliver real change.

Top management focus

Top management plays an active role in all key phases – from planning over training to implementation. Their presence is motivating and sends a clear signal to the organisation that the sales training is not ‘flavour of the month’.